08 Apr 2024

My Journey into Accounting

Up to now couple of years, I’ve been working in billing and funds at Justworks. This expertise launched me to the world of bookkeeping and accounting in methods I didn’t count on: I took a course and browse a textbook in accounting, adopted plain textual content accounting for my private funds, and labored in a double-entry ledger system.

Being such a basic a part of the human expertise, accounting has been round for actually millenia. It fostered mathematical and language improvement. In some cultures, it even predates written language. For that reason, it’s not stunning that accounting makes use of a really explicit vocabulary and set of ideas that may be intimidating to a newcomer. Credit and debits. Property and liabilities. Steadiness sheet. Ledgers and journals.

It took me some time to get used to those issues. However as soon as I did, I noticed they aren’t that troublesome. Possibly it’s only a matter of discovering the fitting method to clarify them.

This collection of articles is my try to seize a few of my “a-ha” moments whereas studying accounting. Hopefully, it would assist somebody on the market grasp these concepts in a extra intuitive and fashionable method.

On this first article, we’ll begin with the fundamentals: bookkeeping.

Disclaimer: on this article, I’ll simplify some ideas and use barely totally different terminology than conventional accounting for didactic functions. In the event you’re an accountant, please bear with me.

Bookkeeping With out Ledgers

At its core, accounting is about protecting observe of countable issues over time. Among the oldest paperwork archelogists have discovered register portions in outdated societies: meals, animals, folks, cash. These days, accounting is normally fascinated with monitoring cash whereas different areas (resembling stock administration or the census bureau) depend the remaining. For the remainder of this text, we’ll concentrate on cash.

Let’s begin with a quite simple instance. Think about you’re in a small city with two folks: Alice and Bob. Alice has $100 in her pocket and Bob has $50 as of January 1st, 2024. We’ll document this information in a desk as follows:

| Individual | Quantity |

| ------ | ------ |

| Alice | $100 |

| Bob | $50 |

If nothing modifications, our job is completed. We simply have to go round city and ask every particular person how a lot cash they’ve, tabulate the info, and retailer it in a protected place. Badabing, badaboom!

However cash is supposed to be spent. Alice is finding out for her finals and desires to purchase a ebook. She notices Bob has one copy and proposes to purchase it from him for $20. Bob is joyful to promote her the ebook he hasn’t used shortly and money within the additional $20. Nice deal!

Now that cash has modified arms, we have to replace our data. Alice spent $20 and Bob obtained the identical quantity. Let’s replace our desk.

| Individual | Quantity |

| ------ | ------ |

| Alice | $80 |

| Bob | $70 |

Earlier than continuing, let’s identify a couple of issues. In our data, Alice and Bob are accounts, i.e., locations the place cash is saved. The amount of cash in every account is named a stability. Saying that Alice has $80 is similar as saying that the Alice account’s stability is $80 as of February 1st, 2024.

Definition 1: Account

A spot the place cash is saved.

Definition 2: Steadiness

The amount of cash in an account at a given cut-off date.

Each month, we are able to go round city, ask folks how a lot cash they’ve and write it down. We’re mainly making a snapshot of the city’s monetary state of affairs month-to-month. (Absolutely, most individuals can be irritated by this breach of privateness and I’d most likely be arrested for stalking however let’s ignore this for now.)

What sorts of questions can we reply with this information? Truly, many!

- How a lot cash does every particular person have?

- How a lot cash has every particular person spent or gained over time?

- Who has probably the most cash?

- Who has the least cash?

- How a lot cash is there in whole within the city?

Our data are easy however helpful.

Now, contemplate Alice involves us in the future and asks “How come I’ve $80? I assumed I had extra!” Sadly, all we are able to reply is “That’s what I’ve written down” with our present information. We are able to’t inform, for example, whether or not Alice initially had $0 and obtained $80 or if she had $10,000 and spent $9,920.

Why is that this so?

Properly, we’re solely protecting observe of the present stability of every account. As a result of we erase the outdated stability and exchange it with a brand new one, we don’t know precisely what occurred to that stability over time. We lose the modifications that occurred between snapshots are misplaced.

Might we do higher?

In fact! Accountants have handled this downside for hundreds of years they usually have an answer: ledgers.

Bookkeeping with Single-Entry Ledgers

Let’s now suppose how we may preserve observe of the historic modifications in a scientific method. A method to do that is to write down down every replace because it occurs, not solely the stability in a sure date.

To do that, we’ll change the desk a bit of bit. For instance, we write down that on January 1st, 2024, Alice had $100.

| Account | Description | Date | Quantity | Steadiness |

| ------- | --------------- | ---------- | ------ | ------- |

| Alice | Opening stability | 2024-01-01 | $100 | $100 |

We added some columns to the desk:

- Description: A human-readable rationalization of the transaction (e.g. what it’s about, who received paid, a reference quantity, and so on).

- Date: When the transaction occurred. Apart from ordering transactions, this area can be utilized to group transactions by interval (e.g. month-to-month experiences). It may be enhanced with time info (e.g. hour, minute, second) if wanted.

- Steadiness: The stability of the account after the transaction. This area is redundant nevertheless it’s helpful when inspecting the info.

To date, so good.

Now, let’s check out how we are able to write down that Alice purchased the ebook from Bob.

| Account | Description | Date | Quantity | Steadiness |

| ------- | --------------- | ---------- | ------ | ------- |

| Alice | Opening stability | 2024-01-01 | $100 | $100 |

| Alice | Purchased ebook | 2024-02-01 | -$20 | $80 |

That is totally different… As a substitute of simply updating the present stability, we’re including a brand new row with the transaction particulars. The brand new columns we added earlier are useful in understanding what occurred to the account. We all know that Alice had $100, then spent $20 when shopping for the ebook, and now has $80.

Time for extra definitions: every row on this desk is named an entry and the entire desk is named a ledger.

Definition 3: Entry

A document of a transaction that occurred to an account.

Definition 4: Ledger

A group of entries for an account.

To date, we’ve up to date solely Alice’s ledger. Let’s check out Bob’s:

| Account | Description | Date | Quantity | Steadiness |

| ------- | --------------- | ---------- | ------ | ------- |

| Bob | Opening stability | 2024-01-01 | $50 | $50 |

| Bob | Offered ebook | 2024-02-01 | $20 | $70 |

Now we now have a ledger for every account. Nice!

This technique we carried out proper now is named a single-entry bookkeeping system. Every account has its personal ledger and we write down entries that have an effect on one account at a time. This can be a easy system that works properly for small companies or private funds.

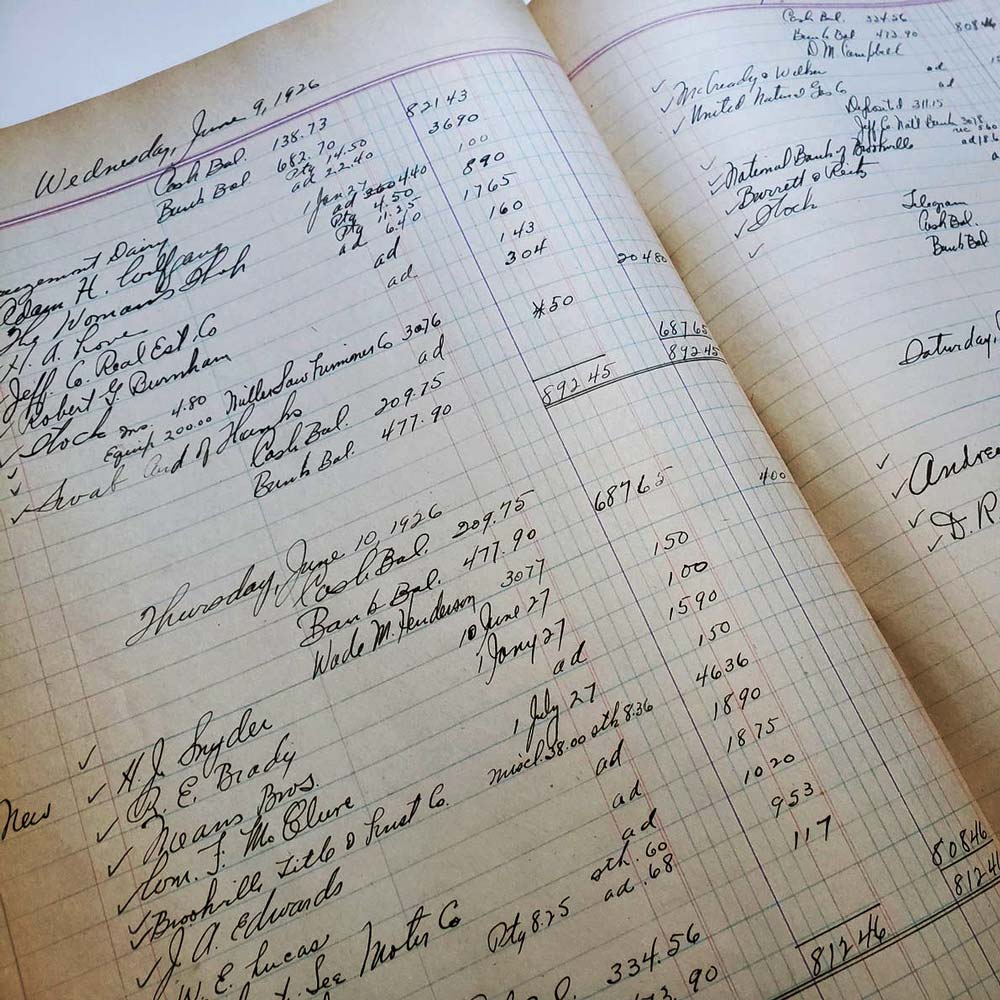

Ledgers are typically known as journal or ebook as a result of, up to now, they had been bodily books the place accountants would write down transactions. Within the fashionable world, although, they’re normally saved in a database.

An essential attribute of a ledger is that the info is immutable. As soon as an entry is written, it can’t be modified in any respect as a result of we need to protect the ledger’s full historical past. No extra erasing or scribbling over entries.

This raises the query: what occurs if we make a mistake?

Right here’s an instance. Say the proper worth for the ebook is $30 however we wrote down $20. If we had been in a mutable system, we may simply replace the quantity within the authentic entry as follows:

| Account | Description | Date | Quantity | Steadiness |

| ------- | --------------- | ---------- | ------ | ------- |

| Alice | Opening stability | 2024-01-01 | $100 | $100 |

| Alice | Purchased ebook | 2024-02-01 | -$30 | $70 |

There are various issues with this strategy although. We lose the historical past of the unique quantity. We are able to’t inform that we made a mistake and corrected it. We can also’t inform if the unique quantity was appropriate and we made a mistake within the correction.

Might we do higher?

Sure! As a substitute of updating the unique entry, we are able to write a brand new entry to cancel the outdated one and write a brand new one with the right amount. Let’s see how this appears to be like:

| Account | Description | Date | Quantity | Steadiness |

| ------- | --------------- | ---------- | ------ | ------- |

| Alice | Opening stability | 2024-01-01 | $100 | $100 |

| Alice | Purchased ebook | 2024-02-01 | -$20 | $80 |

| Alice | Right ebook worth | 2024-02-01 | $20 | $100 |

| Alice | Purchased ebook | 2024-02-01 | -$30 | $70 |

The tip end result is similar as updating an entry in-place: the stability is $70. Nonetheless, we are able to now see that we made a mistake and corrected it. We are able to additionally see the unique quantity and the rationale for the correction. This offers us an audit path of modifications.

In a method, a ledger is much like occasion sourcing in Pc Science. In occasion sourcing, we retailer occasions that occurred within the system and use them to compute the present state of the system. That is in distinction to storing simply the state of the system and updating it in-place. Occasion sourcing has many advantages, like with the ability to replay occasions or to rebuild the state of the system at any cut-off date.

If our system solely cares a couple of single account at a time, a single-entry ledger system is sufficient. Consider a private finance app that you just use to maintain observe of your cash or a gymnasium that tracks how a lot their members paid for the service. Nonetheless, monetary programs are normally extra advanced than that and transactions usually contain a number of accounts directly.

For these advanced situations, accountants developed a extra strong system: double-entry bookkeeping.

Bookkeeping with Double-Entry Ledgers

Let’s revisit the instance of Alice shopping for the ebook from Bob and see the ledgers for each accounts:

| Account | Description | Date | Quantity | Steadiness |

| ------- | ------------------ | ---------- | ------ | ------- |

| Alice | Opening stability | 2024-01-01 | $100 | $100 |

| Alice | Purchased ebook | 2024-02-01 | -$20 | $80 |

| Account | Description | Date | Quantity | Steadiness |

| ------- | ------------------ | ---------- | ------ | ------- |

| Bob | Opening stability | 2024-01-01 | $50 | $50 |

| Bob | Offered ebook | 2024-02-01 | $20 | $70 |

Did you discover how the transactions are associated to one another? The $20 Alice spent is similar $20 Bob obtained. We all know that however the system doesn’t since we’re not explicitly stating this relationship in our ledgers. It might be the case the Alice purchased the ebook from Bob and Bob obtained the cash from Charlie. We are able to’t inform the distinction when studying the ledgers.

A primary step in making this relationship express is to group associated entries right into a transaction. Let’s add the Transaction column to our desk:

| Account | Transaction | Description | Date | Quantity | Steadiness |

| ------- | ---------- | ------------------ | ---------- | ------ | ------- |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | $100 |

| Alice | 3 | Guide sale | 2024-02-01 | -$20 | $80 |

| Account | Transaction | Description | Date | Quantity | Steadiness |

| ------- | ---------- | ------------------ | ---------- | ------ | ------- |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | $50 |

| Bob | 3 | Guide sale | 2024-02-01 | $20 | $70 |

On this instance, we now have the next transactions:

- Transaction 1: Alice’s opening stability.

- Transaction 2: Bob’s opening stability.

- Transaction 3: Alice purchased a ebook from Bob.

Now, we explicitly state that the $20 Alice spent is similar $20 Bob obtained. No extra ambiguity.

Definition 5: Transaction

A bunch of associated entries that have an effect on totally different accounts.

The distinction between our present system and the earlier one is that we’re now grouping associated entries into transactions. Since every transaction impacts a number of accounts, we are able to now see how cash flows between accounts. By including transactions to the tables, we are actually working with a double-entry bookkeeping system.

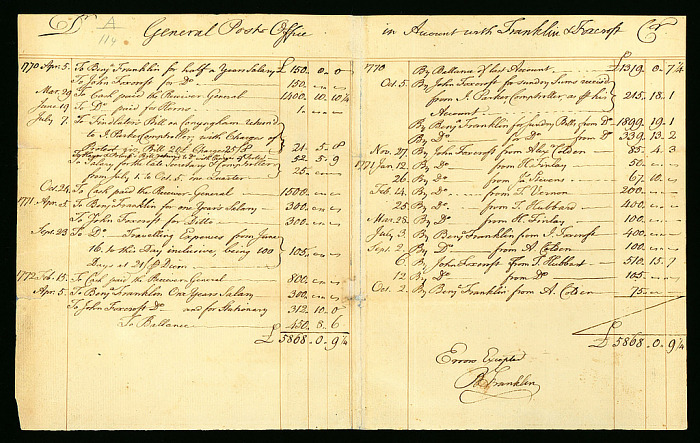

Historically, accountants would use two columns to signify the circulate of cash between accounts: credit and debits. When cash leaves an account, the quantities goes within the credit score column. Incoming cash seems within the debit column.

Definition 6: Credit score

An entry that represents cash leaving an account.

Definition 7: Debit

An entry that represents cash getting into an account.

(Professional-tip: Ignore what you understand about credit score and debit playing cards for now.)

When Alice pays Bob $20, we are saying Alice’s account is credited $20 and Bob’s account is debited $20. Let’s signify this in our desk:

| Account | Transaction | Description | Date | Debit | Credit score |

| ------- | ---------- | ------------------ | ---------- | ----- | ------ |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | |

| Alice | 3 | Purchased ebook | 2024-02-01 | | $20 |

| Account | Transaction | Description | Date | Debit | Credit score |

| ------- | ---------- | ------------------ | ---------- | ----- | ------ |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | |

| Bob | 3 | Offered ebook | 2024-02-01 | $20 | |

I wished to make a couple of of factors earlier than persevering with our journey.

First, the purpose of double-entry bookkeeping is to scale back errors, particularly those which might be arduous to note. Do not forget that, for hundreds of years, accountants had been utilizing pen and paper to maintain observe of insane quantities of cash. Small errors may result in massive issues. Writing debits and credit in several columns, as we did above, reduces the possibility of constructing errors. Your hand is actually moved to totally different locations on the paper when writing debits and credit.

Actual world accounting journals wouldn’t even put these columns side-by-side. As a substitute, they might be in several elements of the web page. In truth, accounting journals had been symmetrical: the left aspect was for debits and the fitting aspect, for credit. One thing like this:

Debit Alice's account Credit score

-------------------------------------------------------------------------------

-------------------------------------------------------------------------------

| Date | Description | $ | | Date | Description | $ |

| ---------- | --------------- | ---- | | ---------- | --------------- | ---- |

| 2024-01-01 | Opening stability | $100 | | | | |

| | | | | 2024-02-01 | Purchased ebook | $20 |

This format is usually known as a T-account (an analogy to the identical: the highest with the account identify, the left aspect with debits, and the fitting aspect with credit). For that reason, many accountants will confer with debits as entries that go on the left aspect and credit as those that go on the fitting aspect.

Pc programs don’t want to make use of this format, although, because it doesn’t essential stop software program bugs. As a substitute, it is not uncommon to have a single quantity column and one other column to point whether or not the quantity is a debit or a credit score. For instance:

| Account | Transaction | Description | Date | Sort | Quantity |

| ------- | ---------- | ------------------ | ---------- | ------ | ------ |

| Alice | 1 | Opening stability | 2024-01-01 | Debit | $100 |

| Alice | 3 | Purchased ebook | 2024-02-01 | Credit score | $20 |

Second, discover how we’re utilizing a optimistic quantity even when cash is leaving Alice’s account. Traditionally, accountants don’t like destructive numbers within the books as they solely turned standard a lot later in Europe. Pc programs are superb with destructive numbers, although. As a substitute of getting two columns, we may simply use a single column and undertake a conference through which credit are destructive and debits are optimistic, or vice-versa. For instance:

| Account | Transaction | Description | Date | Quantity |

| ------- | ---------- | ------------------ | ---------- | ------ |

| Alice | 1 | Opening stability | 2024-01-01 | $100 |

| Alice | 3 | Purchased ebook | 2024-02-01 | -$20 |

In the event you pay shut consideration to this final instance, that is precisely what we had been doing earlier than. The distinction is that now we perceive that the quantity is destructive as a result of it’s a credit score. (Technically, utilizing destructive numbers for credit is likely to be a limitation if we’re making an attempt to undo a credit score entry with out making a debit entry however we don’t should be that choosy for now.)

Lastly, I’m not an enormous fan of outdated nomenclature for custom’s sake. We may rename credit as outgoing cash and debits as incoming cash with out shedding precision. In my view, it is a bit much less complicated.

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | ------------------ | ---------- | -------- | -------- |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | |

| Alice | 3 | Purchased ebook | 2024-02-01 | | $20 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | ------------------ | ---------- | -------- | -------- |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | |

| Bob | 3 | Offered ebook | 2024-02-01 | $20 | |

Candy!

A basic precept of double-entry bookkeeping is that the full amount of cash within the system stays the identical after every transaction. A specific account can improve or lower its stability over time however the sum of all balances should stay fixed. Nothing is misplaced, nothing is created, every part is transacted. It’s a closed system.

Definition 6: Double-Entry Ledger

A system of accounting the place every transaction is recorded a number of entries. The amount of cash leaving accounts is the same as the amount of cash getting into different accounts in each transaction.

Okay, you is likely to be pondering: “Wait a minute, these opening balances go in opposition to what you simply stated!” and also you’re proper. Transactions 1 and a pair of change the full amount of cash within the system from $0 to $150. We must always do higher than stating a rule solely to interrupt it within the very subsequent sentence.

Let’s assume all the cash that Alice and Bob have comes from a financial institution. Then, let’s create an account for this financial institution and use this account as the opposite aspect of the opening stability transactions.

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Financial institution | 1 | Alice's opening stability | 2024-01-01 | | $100 |

| Financial institution | 2 | Bob's opening stability | 2024-01-01 | | $50 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | |

| Alice | 3 | Purchased ebook | 2024-02-01 | | $20 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | |

| Bob | 3 | Offered ebook | 2024-02-01 | $20 | |

On this instance, we don’t care the place the opening balances come from precisely. We simply want to verify cash is coming from someplace. The checking account is a sort of phony account that’s there simply to assist us comply with the principles. In accounting phrases, it’s known as a contra account to the opposite accounts. The essential factor is that every one transactions are balanced, i.e., “credit equal debits”.

Definition 7: Contra Account

An account that’s used to offset one other account. It’s used to maintain the accounting equation in stability.

Our system is now full. We now have a double-entry ledger system that retains observe of cash flowing between accounts. We are able to reply many questions on the monetary state of affairs of Alice and Bob and we now have a transparent audit path of all transactions that occurred.

Let’s contemplate a extra advanced instance. When Alice buys the ebook, she by chance makes use of the unsuitable bank card and must pay $2 in international change charges. Bob, however, pays $2 in gross sales taxes to the federal government, $1 in bank card charges. How will we preserve observe of this?

The key in double-entry bookkeeping is to make use of accounts for every part. As we did earlier than, we mannequin this circulate by creating new accounts: one for the bank card firm and one other for the tax authority. Then, when creating the transaction, we add new entries as essential.

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Financial institution | 1 | Alice's opening stability | 2024-01-01 | | $100 |

| Financial institution | 2 | Bob's opening stability | 2024-01-01 | | $50 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | |

| Alice | 3 | Purchased ebook | 2024-02-01 | | $20 |

| Alice | 3 | International change charge | 2024-02-01 | | $2 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | |

| Bob | 3 | Offered ebook | 2024-02-01 | $20 | |

| Bob | 3 | Gross sales tax | 2024-02-01 | | $2 |

| Bob | 3 | Bank card charge | 2024-02-01 | | $1 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| CC | 3 | Alice's bank card charge | 2024-02-01 | $2 | |

| CC | 3 | Bob's bank card charge | 2024-02-01 | $1 | |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Tax | 3 | Bob's gross sales tax | 2024-02-01 | $2 | |

We modified transaction 3 as follows:

- Alice pays $20 to Bob and $2 to the bank card firm.

- Bob receives $20 from Alice, pays $2 to the tax authority, and $1 to the bank card firm.

- The bank card firm receives $2 from Alice and $1 from Bob.

- The tax authority receives $2 from Bob.

Discover that transaction 3 has greater than two entries. It has eight entries, to be exact. That is completely wonderful! We are able to have as many entries as we have to signify the circulate of cash between accounts so long as the transaction is balanced, i.e., credit = debits.

It’s a frequent mistake to suppose that double-entry bookkeeping limits transactions to 2 entries at a time. The method is named “double-entry” not as a result of there are solely two entries however as a result of every transaction has two sides: one aspect the place cash leaves an account and one other aspect the place cash enters one other account. I assume “many-entry bookkeeping” doesn’t sound nearly as good.

Double-Entry Bookkeeping is a Directed Graph

I hope these ideas are clear thus far. We now have accounts, entries, transactions, incoming cash, and outgoing cash. With apply, you’ll be capable of learn and write these tables with ease.

However I’ve a confession to make: I’m a visible particular person. I like to attract and see issues after I’m studying. So I began to suppose: how can we visualize this information in a method that is sensible to me? After utilizing double-entry bookkeeping for some time in my private funds and making an attempt to return with a visualization for my ledgers, it lastly clicked: we’re modeling cash circulate as a directed graph.

Take into consideration this: An account is a node within the graph, a credit score entry is an outgoing edge with an amount of cash leaving this node whereas a debit is an incoming edge with cash flowing to a different node. A transaction, then, teams and enforces a situation on a set of edges: the outgoing edges will need to have the identical sum of cash because the incoming edges.

Let’s check out the instance we’ve been utilizing thus far. First, we begin with Alice’s and Bob’s accounts and the cash they saved within the financial institution:

A couple of feedback on this graph:

- An account is a spherical node with the account identify.

- A transaction is a sq. node with the transaction quantity.

- A credit score entry goes from an account to a transaction.

- A debit entry goes from a transaction to an account.

- The entry’s amount of cash is written on the sting.

- An account’s stability is the sum of the quantities of the incoming edges minus the sum of the quantities of the outgoing edges.

We are able to see that transaction 1 strikes $100 from the financial institution to Alice. Transaction 2 strikes $50 from the financial institution to Bob. The overall amount of cash within the system is $150.

Then, Alice buys a ebook from Bob:

We are able to see that transaction 3 strikes $20 from Alice to Bob. Therefore, Alice has $80 and Bob, $70.

We haven’t added charges and taxes but. Let’s do that:

Oof, that’s a number of edges! Transaction 3 could be very advanced because it conflates what Alice is paying Bob with the charges and taxes they pay to different events. We may make this simpler by splitting this transaction into two smaller ones:

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Financial institution | 1 | Alice's opening stability | 2024-01-01 | | $100 |

| Financial institution | 2 | Bob's opening stability | 2024-01-01 | | $50 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Alice | 1 | Opening stability | 2024-01-01 | $100 | |

| Alice | 3 | Purchased ebook | 2024-02-01 | | $22 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Bob | 2 | Opening stability | 2024-01-01 | $50 | |

| Bob | 3 | Offered ebook | 2024-02-01 | $19 | |

| Bob | 4 | Gross sales tax | 2024-02-01 | | $2 |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| CC | 3 | Transaction charge | 2024-02-01 | $3 | |

| Account | Transaction | Description | Date | Incoming | Outgoing |

| ------- | ---------- | -------------------------- | ---------- | -------- | -------- |

| Tax | 4 | Bob's gross sales tax | 2024-02-01 | $2 | |

And as a graph:

We simplified the transactions a bit of bit:

- Alice sees $22 leaving her account however Bob solely receives $19. The remaining $3 goes to the bank card firm.

- Bob pays gross sales taxes in a special transaction.

No matter how we mannequin the transactions, the account balances are the identical. Alice has $78, Bob has $69, the tax authority has $2, and the bank card firm has $3. It’s the accountant’s job to resolve the right way to group transactions and entries in a method that is sensible for the enterprise because the bookkeeping system is versatile sufficient to accommodate totally different wants.

These easy examples present how we are able to visualize cash circulate in a double-entry bookkeeping system as a directed graph. The graph grows over time as new transactions are added nevertheless it’s properties stay the identical. In my view, understanding bookkeeping as a graph is a robust method to purpose about many accounting ideas. All of a sudden, issues as stability sheets, revenue statements, and money circulate statements are simply visualizations of this graph. Classes resembling property, liabilities, fairness, revenue, and bills are simply teams of nodes within the graph and it’s fairly simple to grasp whether or not credit or debits improve their balances. It’s a method to make accounting extra intuitive and fewer intimidating to me!

We may go on and on with this instance, including extra complexity to the transactions, creating new accounts, and visualizing the graph because it grows. However I feel we did an incredible job immediately and will take a well-deserved break.

Takeaways

On this article, we’ve coated the fundamentals of bookkeeping. We began with a easy system that solely saved observe of balances, developed it right into a single-entry and, later, right into a double-entry ledger system that fashions cash circulate between accounts. We’ve seen the right way to signify transactions as entries in a ledger and the right way to group associated entries into transactions. Lastly, we’ve seen the right way to visualize a double-entry ledger as a directed graph.

Within the subsequent article, we’ll dive deeper into primary accounting ideas and see how they relate to the graph illustration we’ve seen right here.

Sources

When finding out these ideas, I discovered the next assets significantly useful: