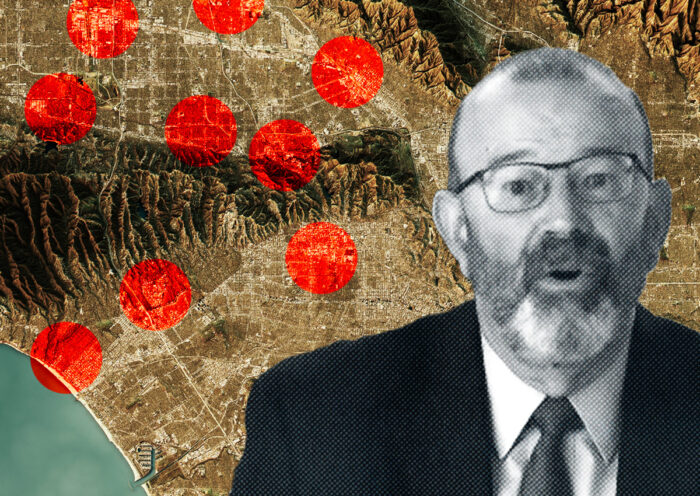

A flood of non-renewal notices for house insurance coverage insurance policies from State Farm will hit upscale neighborhoods from Calabasas to Bel-Air, whereas leaving others comparatively unscathed.

Illinois-based State Farm Basic Insurance coverage has launched new particulars of its non-renewals introduced final month for 30,000 property insurance coverage and 42,000 business house insurance policies throughout the state, KTLA5 reported, citing a brand new submitting with the state.

The numbers recommend the insurance coverage big has taken goal at a number of high-priced ZIP Codes in Los Angeles, whereas sparing others.

State Farm, the state’s largest insurer in 2022, mentioned the transfer would affect 2 % of its whole insurance policies in California and was made to make sure “long-term sustainability.”

The 42,000 house non-renewals signify a whole withdrawal from the business house market in California. The opposite 30,000 non-renewals would affect householders, rental dwellings and different property insurance coverage insurance policies, in line with State Farm.

The brand new submitting with the California Division of Insurance coverage exhibits the place the nonrenewals will likely be concentrated, with State Farm saying it wouldn’t renew insurance policies “that current essentially the most substantial wildfire or hearth following earthquake hazards, or which are in areas of serious focus.”

In areas such because the Hollywood Hills, Rolling Hills Estates and Duarte, lower than 1 % of insurance policies gained’t be renewed.

However in different areas, greater than half of policyholders can be impacted.

In Brentwood’s 90049, State Farm gained’t renew insurance policies for 61.5 % of its 2,114 policyholders, in line with the submitting. In Bel-Air’s 90077, the non-renewed insurance policies rise to 67.4 %, with Pacific Palisades’ 90272 hitting 69.4 %, or 1,626 policyholders.

In Beverly Hills’ 90210, 46.1 % of policyholders gained’t be renewed, similar to 46.9 % of Malibu’s 90265.

San Fernando Valley communities have been additionally impacted, together with 60.4 % of State Farm policyholders in Calabasas, 50.4 % of these in Tarzana, and 40.1 % in Encino, in line with the submitting.

Clients affected by the choice will retain protection till their present contract is up. The corporate mentioned these impacted will likely be notified between July 3 and Aug. 20.

“This determination was not made calmly and solely after cautious evaluation of State Farm Basic’s monetary well being, which continues to be impacted by inflation, disaster publicity, reinsurance prices and the restrictions of working inside decades-old insurance coverage laws,” the corporate mentioned in a press release.

“State Farm Basic takes significantly our duty to take care of sufficient claims-paying capability for our clients and to adjust to relevant monetary solvency legal guidelines. It’s essential to take these actions now,” the corporate mentioned.

The corporate additionally mentioned it should proceed working with the Division of Insurance coverage, Gov. Gavin Newsom and different policymakers as they pursue reforms “to determine an surroundings through which insurance coverage charges are higher aligned with threat.”

In February, the state’s Division of Insurance coverage introduced proposals to reform California’s insurance coverage laws. The brand new proposal would permit insurance coverage firms to change from utilizing historic information to disaster modeling, that means firms would calculate projections of future threat when elevating charges and move on the price of reinsurance to customers.

The brand new adjustments are anticipated to take impact on the finish of the 12 months.

Final 12 months, State Farm introduced it could cease accepting new insurance coverage functions for all enterprise and private property in California. Since then, different insurance coverage firms, together with Allstate, have introduced comparable adjustments.

This comes as California’s property insurer of final resort informed lawmakers that it’s financially unprepared to cowl the prices of a serious disaster within the state. The plan now faces $311 billion in potential losses, up from $50 billion six years in the past, California FAIR Plan President Victoria Roach mentioned in a state legislative listening to.

— Dana Bartholomew